Description

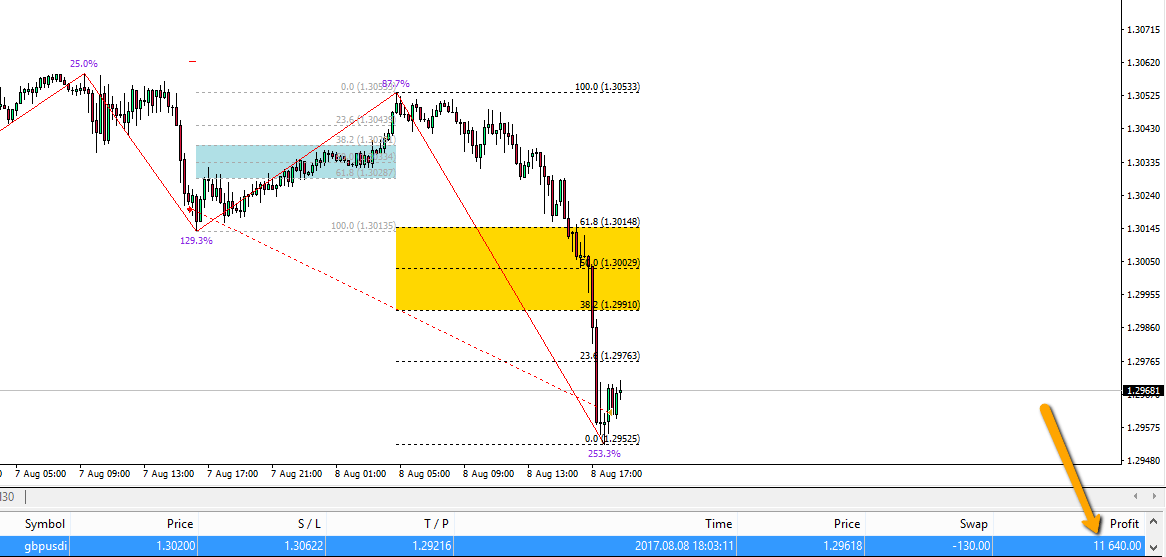

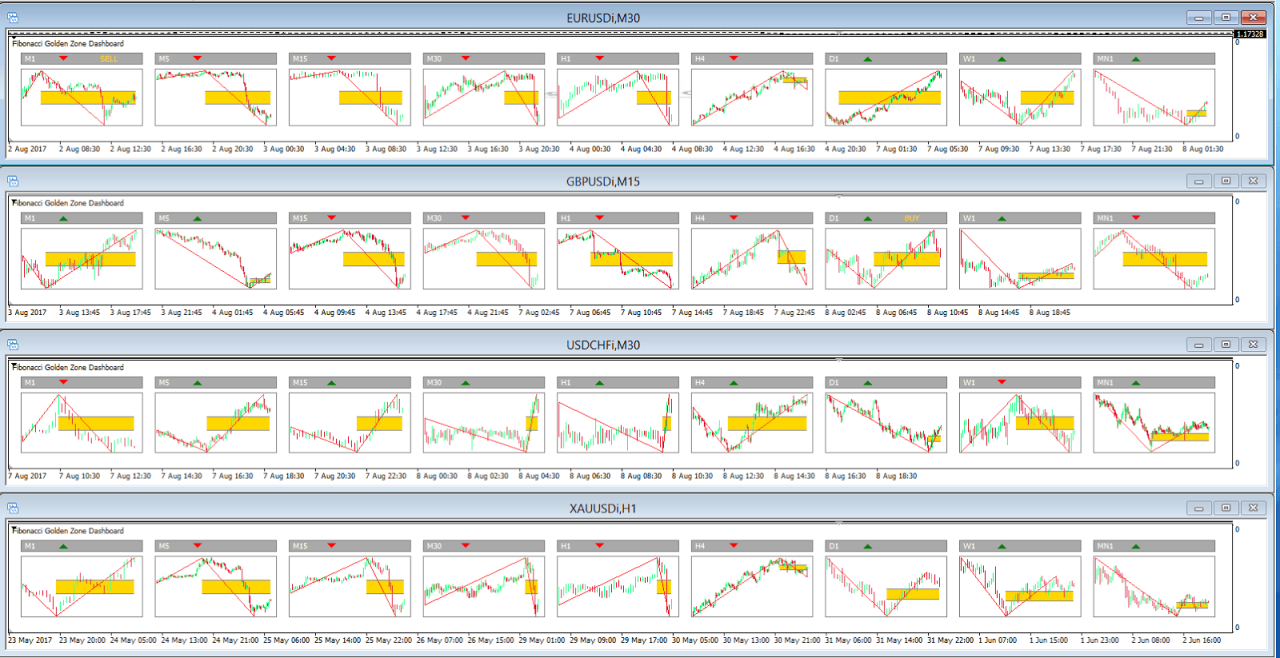

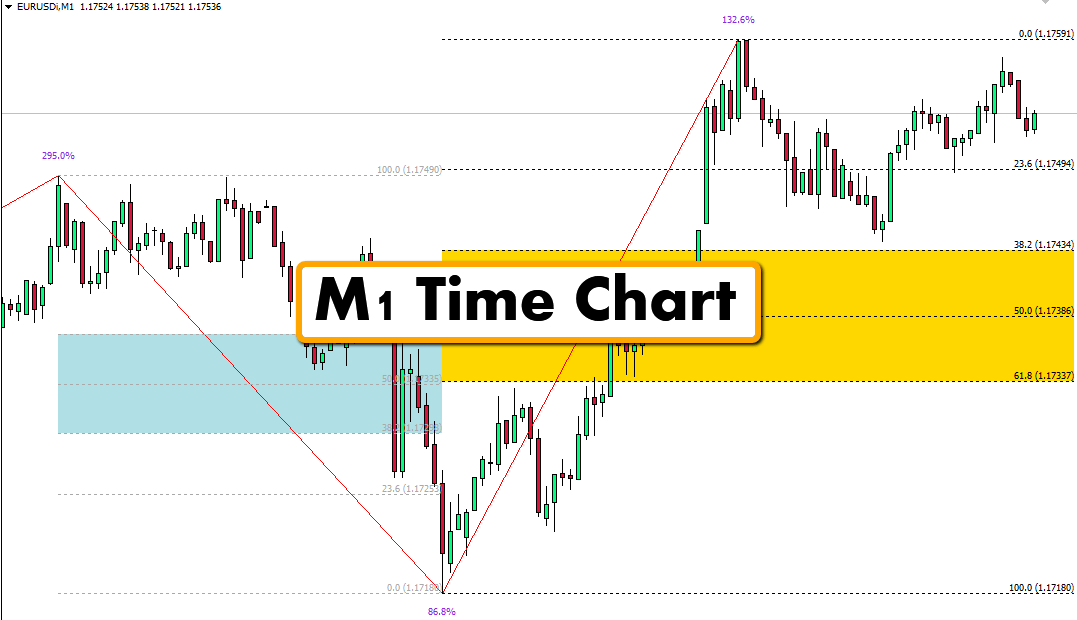

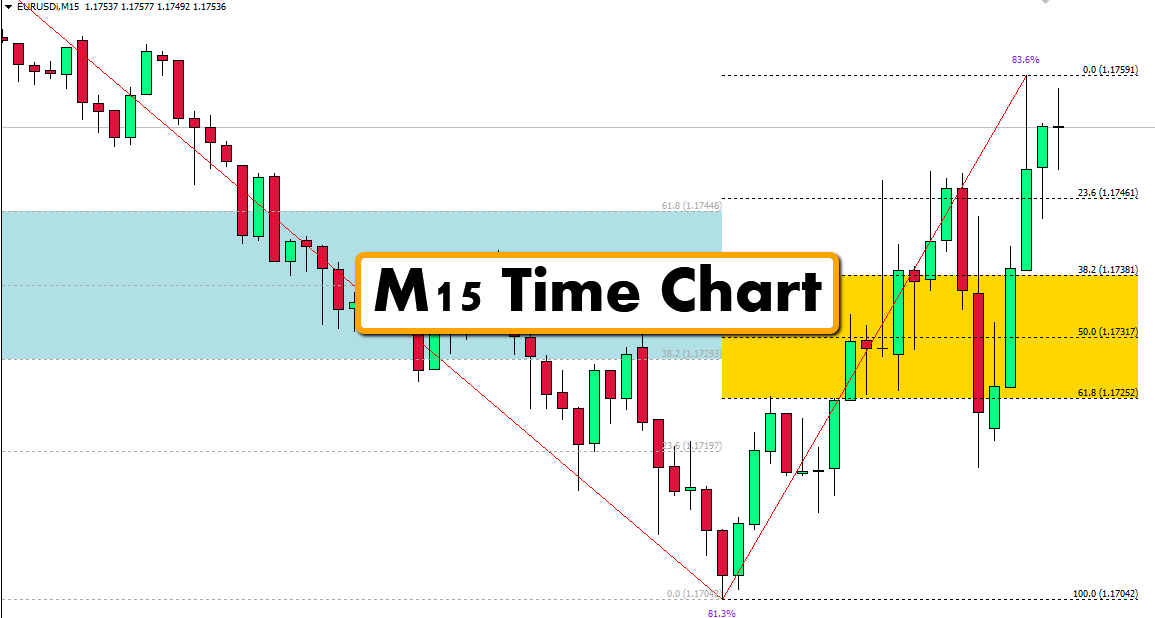

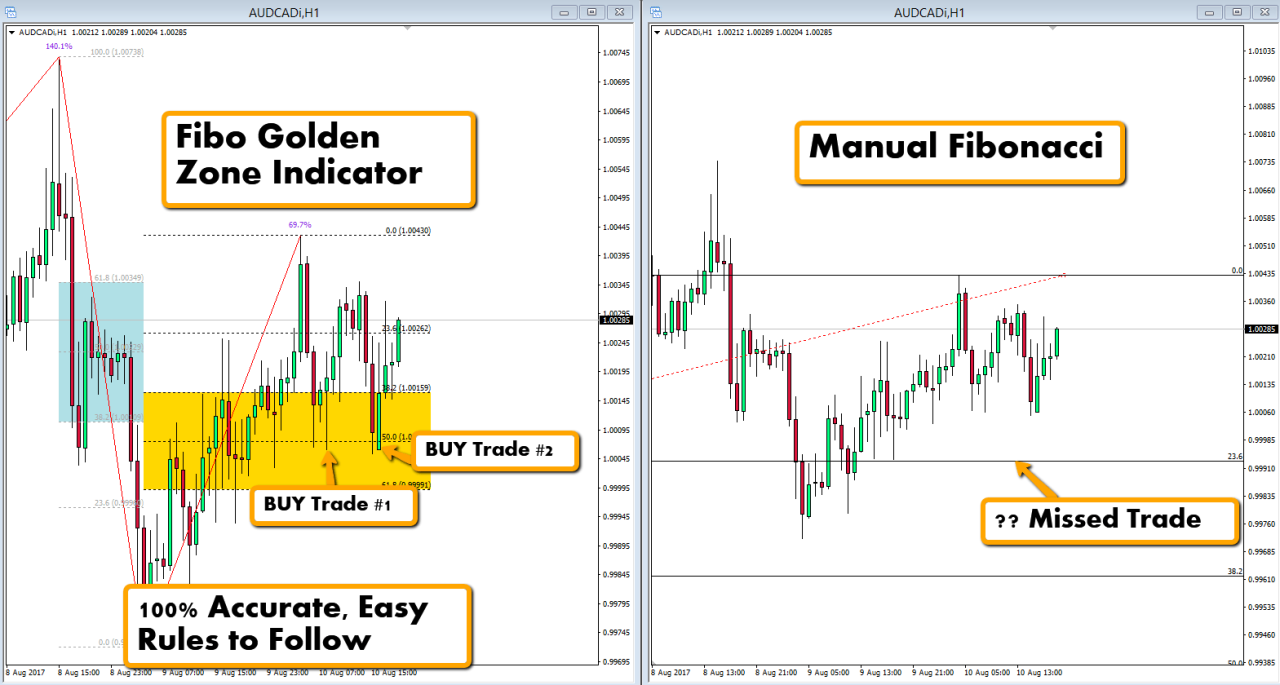

In the above example, there has not been a signal yet to sell with the Fibonacci Golden Zone Indicator.

You see in these four examples how much easier and less work it is to find pullback trades with the Fibonacci Golden Zone Indicator?

It’s incredible how times change… and its incredible how one great discovery can change a whole life!

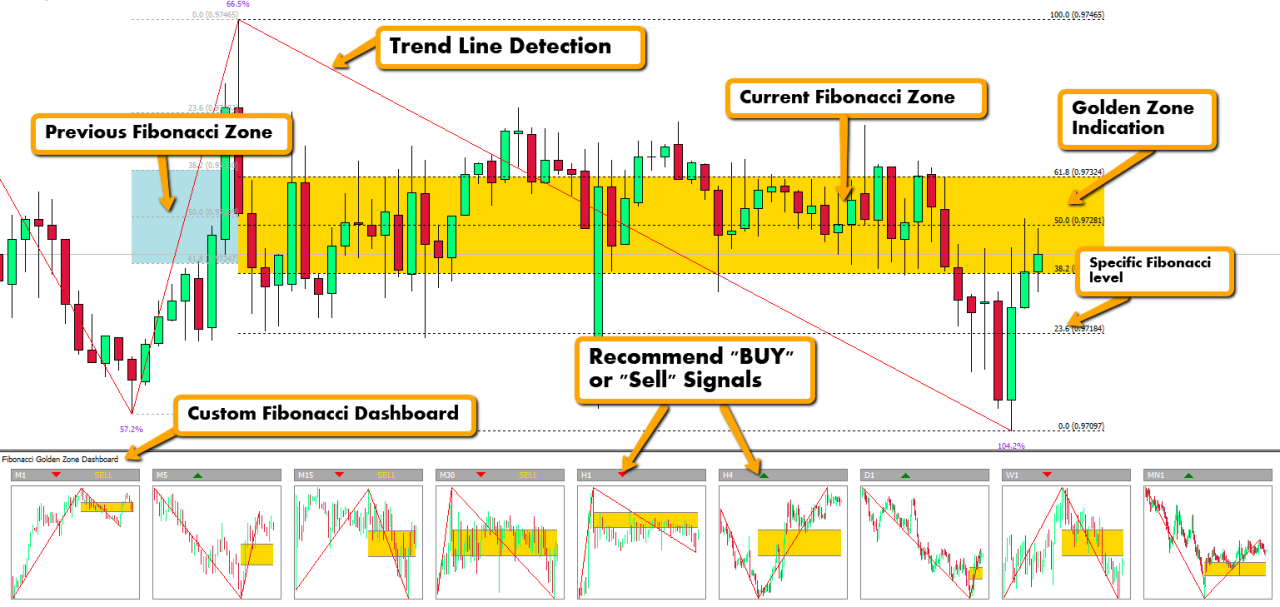

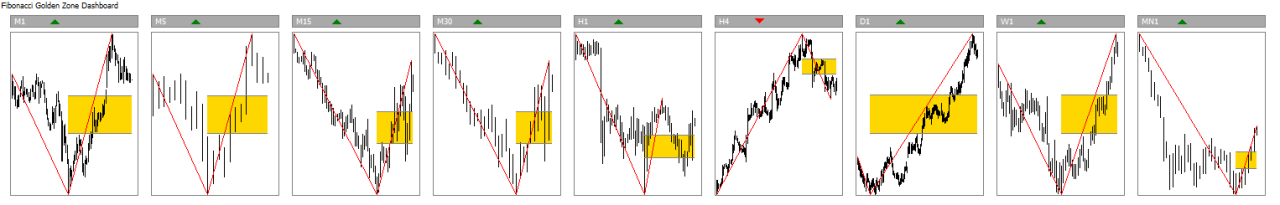

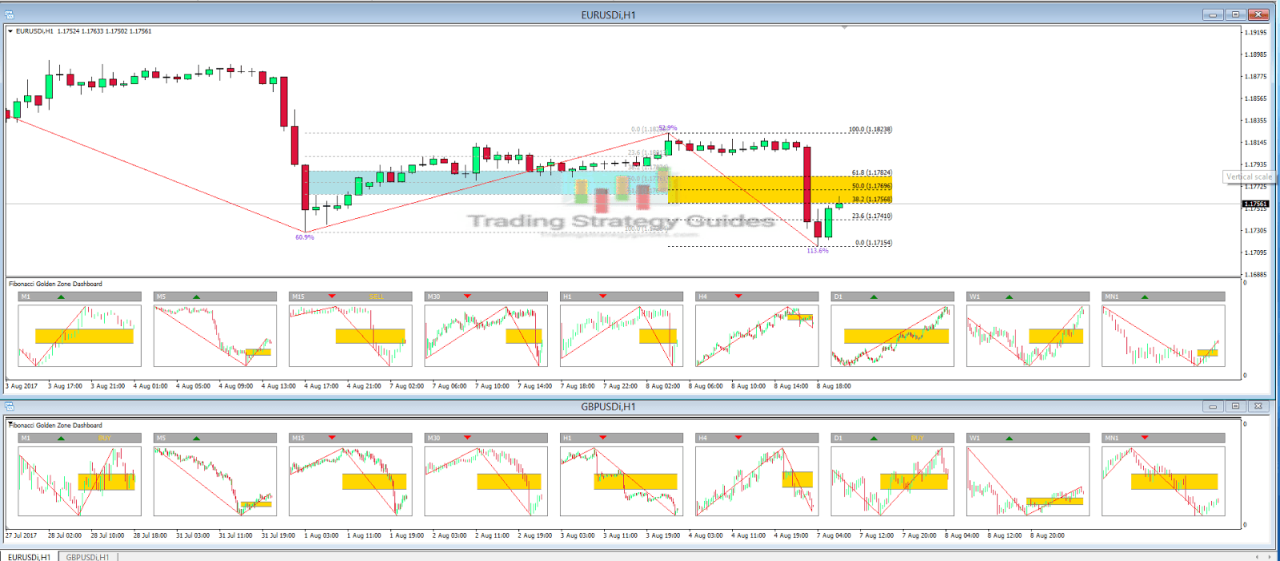

This is fully customizable and give you, the trader, the ability to pull whatever market and whatever time frame you wish to trade!

You can limit what time frames you want to see the Fibonacci Dashboard…

We all have busy lives and busy schedules and we know that you just cannot be staring at your charts all day long..

So you know precisely where the price action is at all times! This is a huge benefit because there are countless times we would have missed an entry but did not because we got a pop up alert.

The Fibonacci Golden Zone indicator for MT4 automatically plots Fibonacci retracement levels on a price chart and highlights the key “golden zone” areas where price activity is anticipated based on the established Fibonacci ratio theory.

What is the Fibonacci Golden Zone Indicator?

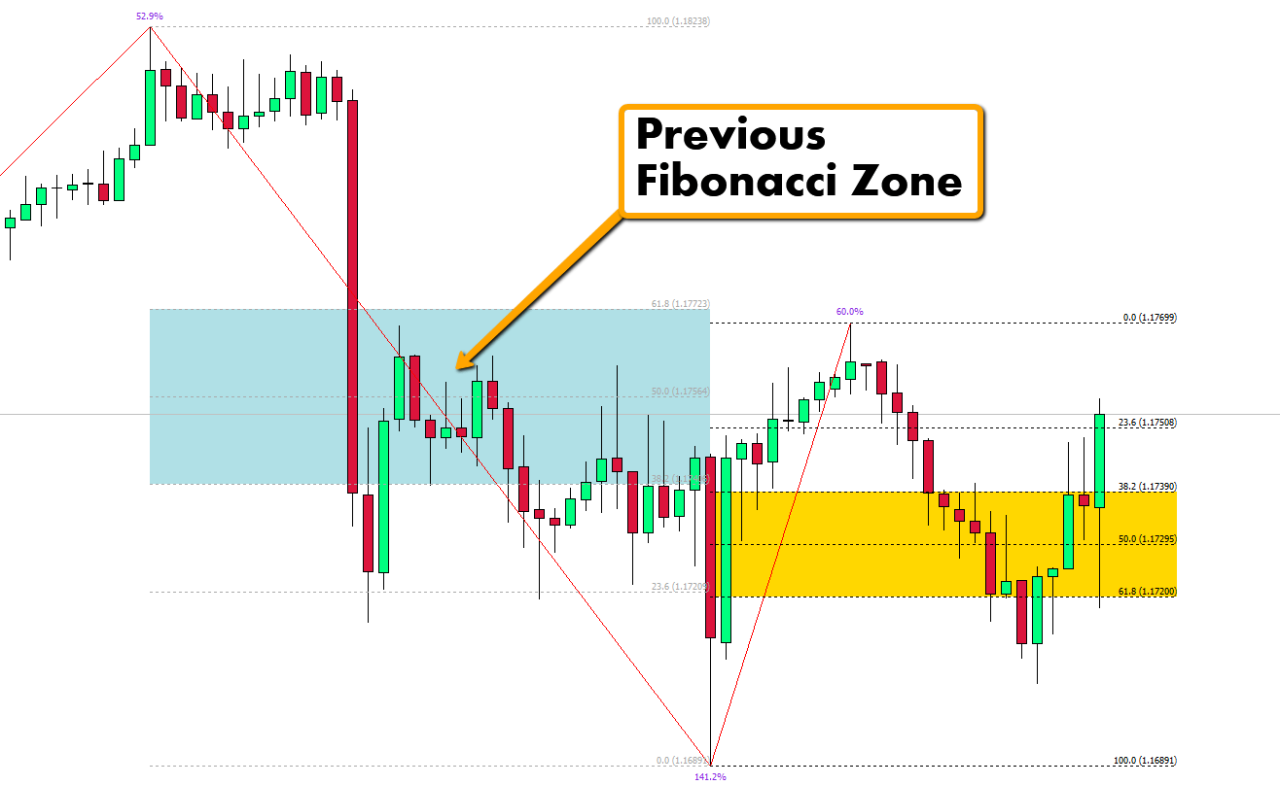

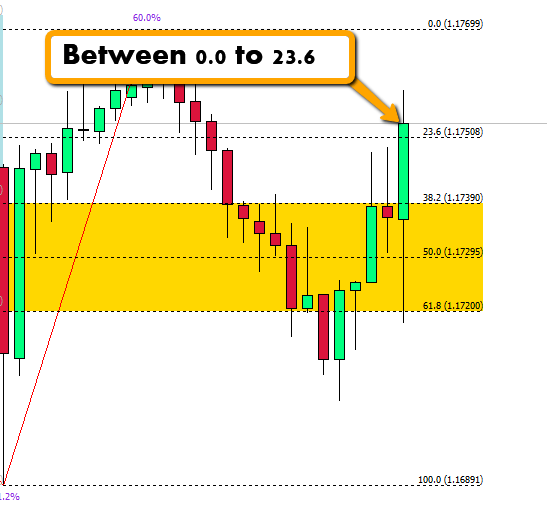

This custom indicator for the MT4 trading platform draws the key Fibonacci retracement ratios of 0.618, 0.5 and 0.382 on the chart when a swing high and low are identified.

It then highlights the zone between the 0.382 and 0.618 levels, known as the “golden zone”, where Fibonacci traders expect the highest probability price action to occur.

Overview of the Fibonacci Sequence and Ratios

The Fibonacci sequence is a series of numbers starting with 0 and 1 where each subsequent number is the sum of the prior two. This mathematical sequence produces an interesting ratio relationship where dividing certain numbers in the sequence by numbers further along produces ratios of approximately 0.618, 0.5 and 0.382.

These ratios are thought to have important applications in financial markets that tend to reverse or find support/resistance at these golden ratio levels.

Benefits of Using the Golden Zone Indicator

The Fibonacci Golden Zone indicator provides automated Fibonacci analysis on MT4 charts to help traders identify:

- Key levels for possible support, resistance and reversals

- High probability areas for entries and targets

- Areas of order flow battles likely to produce volatility

- Gauge overall market directional bias and strength

How the Indicator Works

The Fibonacci Golden Zone indicator applies the established Fib ratios to price action in real time:

Plots Fibonacci Retracement Levels

When a significant swing high and low form on the chart, the indicator plots the Fibonacci retracement lines connecting those points at the 0.382, 0.5 and 0.618 levels.

Highlights “Golden Zone” Areas

The levels between the 0.382 and 0.618 retracements are shaded in a color to clearly identify the “golden zone”. This is the area of highest expected volatility and reversals.

Visual and Alert Signals at Levels

As price interacts with the Fib levels, the indicator can flash on-chart colors and optionally trigger audio/email/push alerts to signal traders.

Customization Settings

Traders can tweak settings like the swing high/low sensitivity, zone shading color, and types of alerts delivered when price reaches key levels.

Trading Strategies with Golden Zone

The Fibonacci Golden Zone offers several possible trading applications:

Entries at Zone Support/Resistance

When price pulls back to the golden zone, traders can look to buy near zone support or sell at zone resistance with stops beyond the zone extremes.

Exits When Zones Break

If price penetrates through a golden zone that had been holding previously, it signals potential exhaustion requiring an exit.

Combining with Other Indicators

Aligning golden zone tests with overbought/oversold oscillators or candles/patterns creates high probability setups.

Optimizing Zone Parameters

Modifying the swing sensitivity and bars back settings can optimize the indicator to fit different trading plans and timeframes.

Using Golden Zone for Analysis

Beyond trade entry signals, the indicator also provides broader analytical insight:

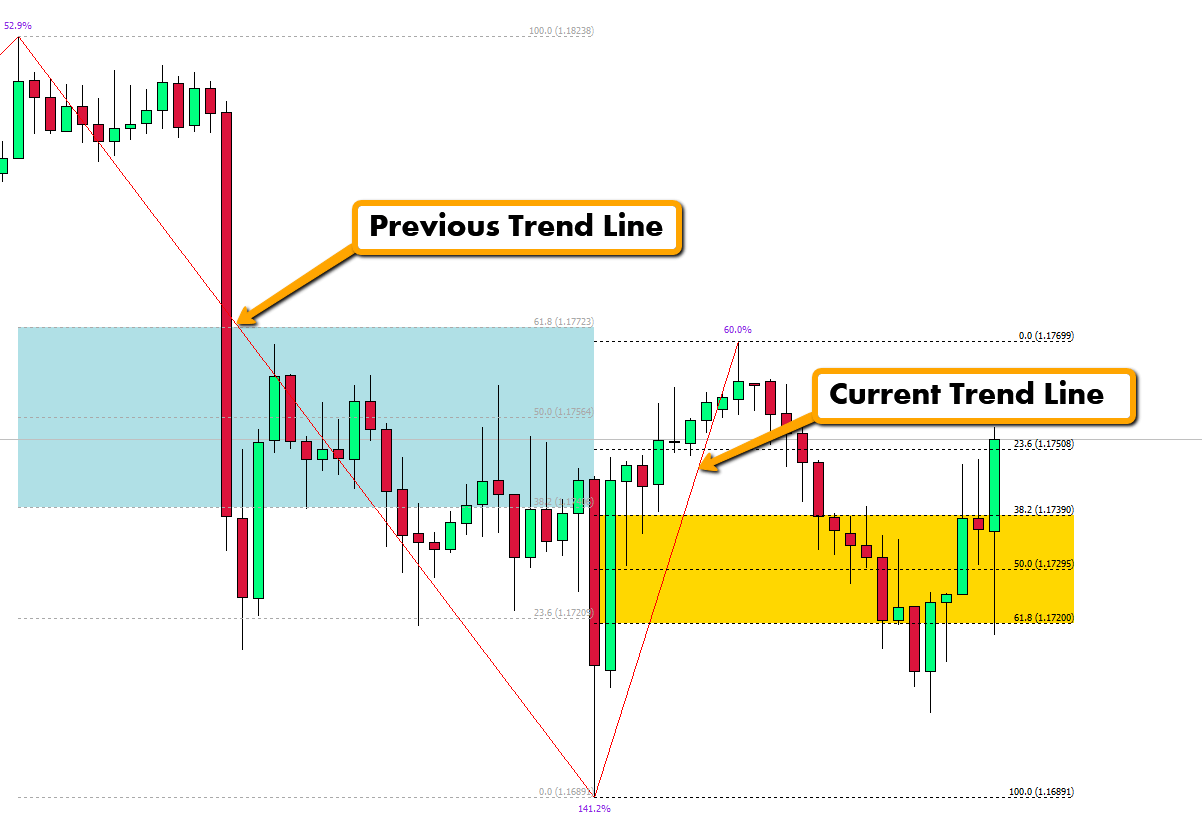

Identifying Key Swing Levels

The plotted Fib levels highlight historic price points that acted as support and resistance during trends and ranges.

Seeing Overall Market Structure

Visualizing golden zones across a chart provides perspective on where significant battles occurred and the directional bias.

Gauge Trend Strength with Pullbacks

Shallow pullbacks that stall and reverse near the golden zone indicate strong trends. Deep pullbacks suggest trend weakness.

Golden Zone in Elliot Wave Theory

Common golf zone alignments with Elliot impulse and corrective waves helps confirm wave counts.

Tips for Effective Usage

Some guidance for using the Fibonacci Golden Zone effectively includes:

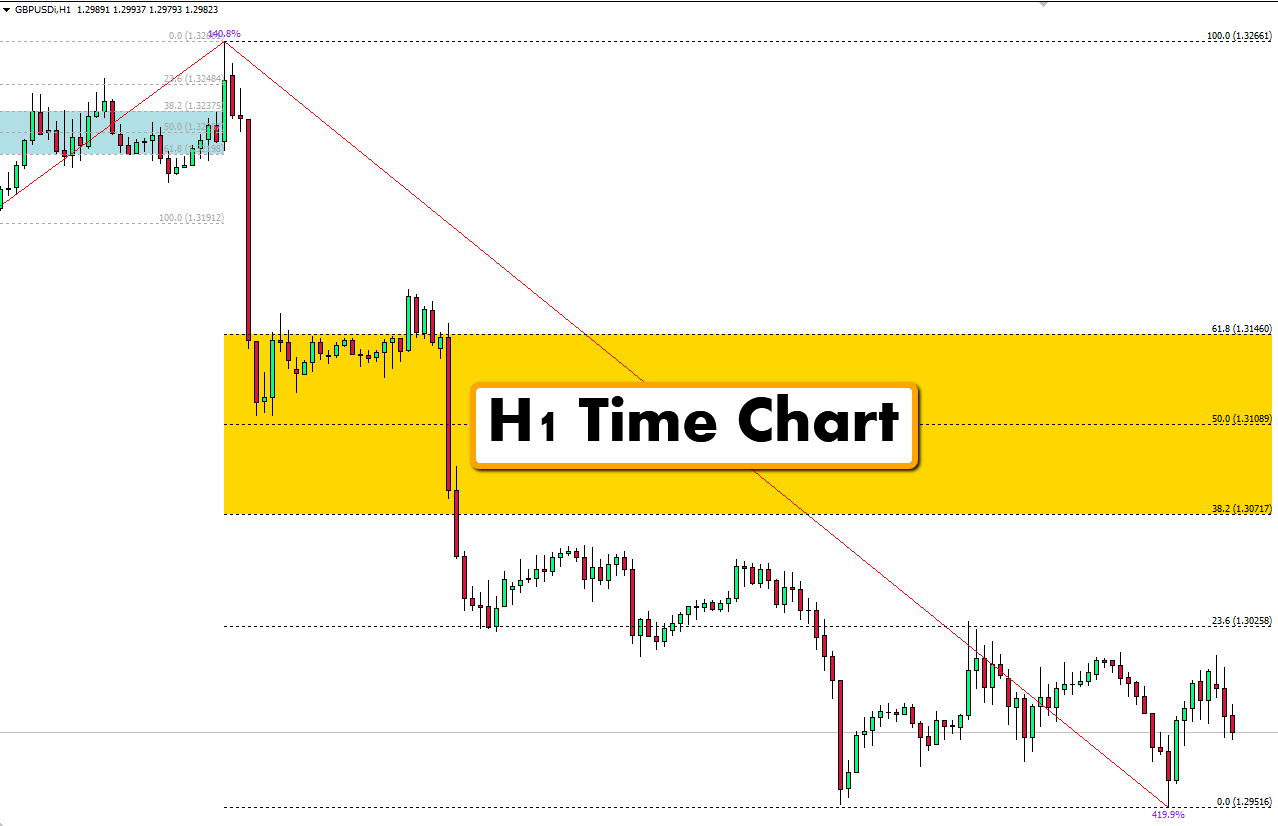

Using on Higher Timeframes

Longer period charts like daily, 4H and 1H smooth noise and provide cleaner structure.

Focusing on Confluence Zones

Levels where multiple golden zone instances overlap suggest extra significance.

Understanding Market Context

Factor in whether markets are ranging or trending when assessing zone tests.

Managing Trades at Zone Levels

Consider partial profits or hedging at golden zones on existing trades rather than all-or-nothing exits.

Strengths and Limitations

Strengths

- Objectively identifies areas of interest

- Levels based on established ratios

Limitations

- Lagging and reactive nature

- Specific levels not precise predictors

Examples of Trades and Setups

Retracement Bounce Entries

After a retracement to the golden zone, a bullish candle close above the zone suggests a long entry. Stop loss goes below the zone.

Breakout Pullback Entries

When price breaks a golden zone but retraces back, traders can buy the pullback for swing trade entries with the recent breakout as stop level.

Exiting at Zone Breaches

Closing out positions when price penetrates and closes past golden zones provides proactive protection before bigger losses.

Stop Loss Placement

Golden zones clearly define risk points for trades. Stops can be placed conservatively beyond the zones.

Conclusion

The Fibonacci Golden Zone indicator offers automated identification of high probability Fibonacci support, resistance and reversal levels on MT4 charts. This provides a valuable input into overall technical analysis.

However, as with any indicator, blindly trading golden zone tests tends to underperform relative to combining zone signals with other confluence factors within the broader price action context. Practice and experience creates skill in interpreting the zones effectively.

When used with proper risk management as part of a structured approach, the Fibonacci Golden Zone indicator can enhance MT4 trading strategies. It remains one of the most popular Fibonacci tools among retail forex and stock index traders.

Key Takeaways

- Automated Fibonacci indicator identifying golden zones

- Looks for bounces off zone support/resistance

- Signals when price breaches zone levels

- Ideal for combining with candle, pattern strategies

- Requires prudent entry/exit timing and risk management

FAQs

What is the ideal setting for the bars back parameter on the Golden Zone indicator?

Most effectively optimize over 200 bars for hourly/4-hour charts and 500 bars for daily charts. But traders should experiment with varying lookbacks to match their style.

When is it best to totally exit a trade based on a Fib level break?

It depends on momentum and technical context, but generally after two closes below a key support zone or two closes above a resistance zone signifies high likelihood of follow through.

Can you use Fib Golden Zone as a standalone system?

It is not advisable to use any indicator on its own. Combining golden zone tests with price action patterns, momentum oscillators, or volume improves probabilities significantly.

How many instances of a Fib zone are needed for it to be considered significant?

There is no definitive rule, but generally 3-4 overlapping golden zones closely together establishes the level as an important decision point and confirms Fib theory relevance.

Should Fib levels be updated after initial plotting or remain static?

Updating golden zones over time rather than leaving initial static levels provides greater adaptability as market conditions evolve. But don’t over-optimize.